Financial Literacy

Financial literacy is the need of the hour for a rapidly developing nation like India since it assures inclusive growth and sustainable prosperity. The Reserve Bank of India (RBI), together with several governmental agencies like SEBI (NISM) and IRDA have been developing training modules, guides and educational programs in the field of financial literacy but this movement requires greater impetus in order to reach the masses. The conventional delivery mechanisms need to be re-invented and scaled up to help the financial literacy program reach millions.

Many efforts are underway and the National Institute of Securities Markets (NISM), a public trust established by SEBI, has set up a National Centre for Financial Education (NCFE). One of the main programs started by NCFE is an initiative called National Financial Literacy Assessment Test (NFLAT). This is India’s first national-level test designed to measure the level of financial literacy among school students of Classes VIII to X. It is primarily aimed at encouraging students to obtain basic financial knowledge on topics such as money, budgeting, investment, banking, savings, insurance, retirement planning and financial planning.

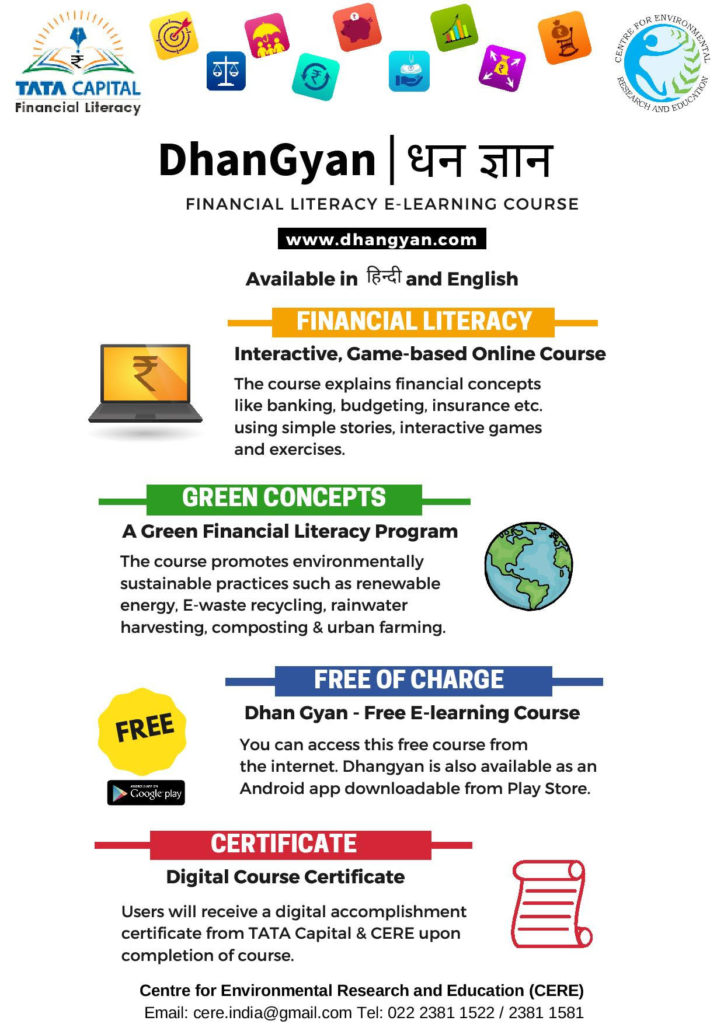

CERE in partnership with Tata Capital is developing a Financial Literacy program that targets secondary school children. The program undertakes exhaustive research in the specialized area of financial literacy and education. This program aims to develop a robust scalable web-based platform that would take Financial Literacy across schools in India, in tandem with the NFLAT curriculum and examination. Driving the maximum number of students to successfully complete the NFLAT exam would also be a measurable indicator of success for the program.

To know more about the project, visit dhangyan.com